What is Ascending triangle pattern in trading ?

Today we’re going to discuss What is Ascending triangle pattern in trading and how to trade it ?

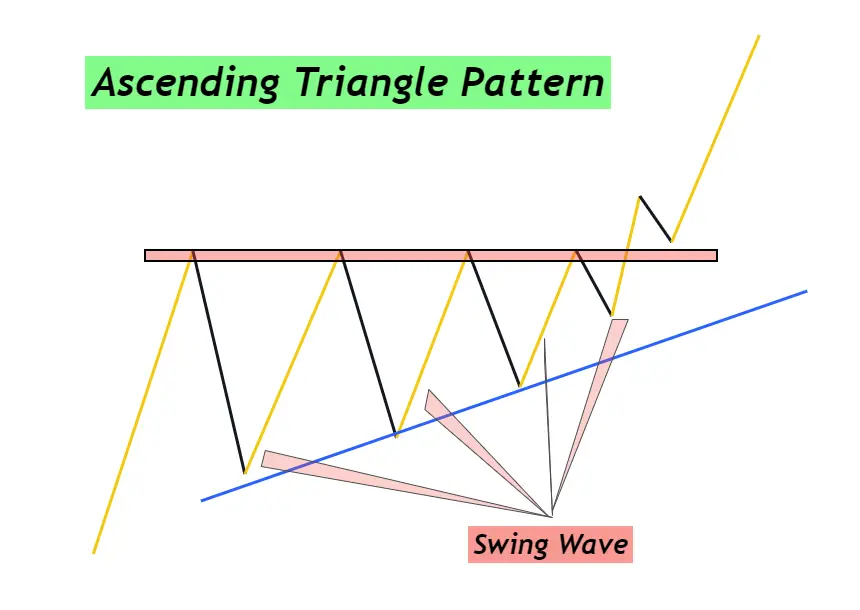

Ascending Triangle Pattern An ascending triangle pattern is a bullish chart pattern that can be found in the price action of a security.

It is characterized by a horizontal resistance line and an upward-slanting support line.

The pattern forms as the security’s price continues to make higher lows while finding resistance at a constant level.

As the price approaches the resistance level, traders may expect a breakout to occur, indicating a potential buy signal.

The pattern is usually considered a reliable bullish signal, but it’s important to note that there is no guarantee of a specific outcome and it’s always important to consider other technical and fundamental factors before making a trading decision.

Additionally, it’s also possible for the pattern to be a continuation pattern, meaning that the upward trend is expected to continue rather than reverse.

It’s crucial to wait for the pattern to be confirmed by a breakout above the resistance line before acting on any potential trade signals. Traders may also consider using stop-loss orders or other risk management strategies to limit potential losses. Additionally, it’s important to keep in mind that the pattern can also sometimes fail, meaning that the price does not break out as expected, and traders should always be prepared for this possibility.