What is Descending triangle pattern in trading ?

today, we’re going to discuss What is Descending triangle pattern in trading and how to trade it.

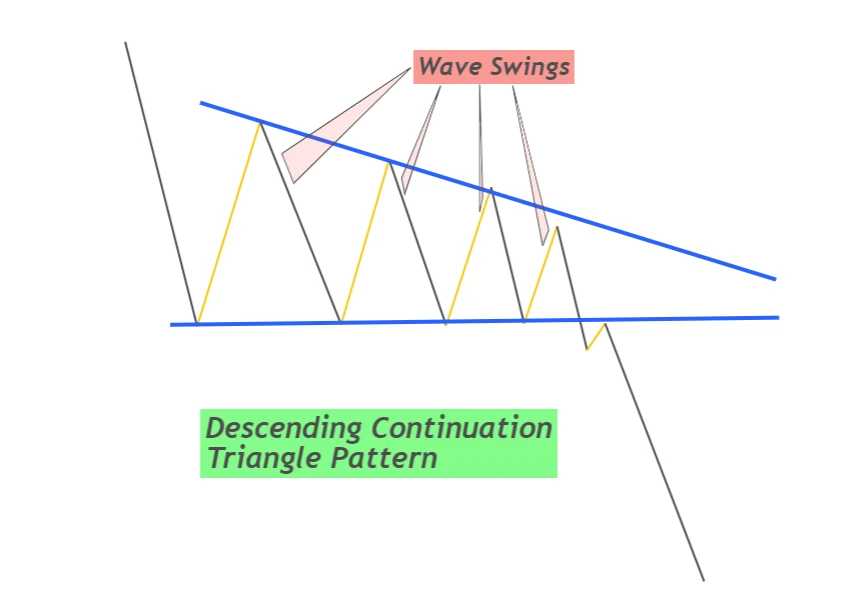

Descending Triangle Pattern

A descending triangle pattern is a bearish chart pattern that can be found in the price action of a security.

It is characterized by a horizontal support line and a downward-slanting resistance line.

The pattern forms as the security’s price continues to make lower highs while finding support at a constant level.

As the price approaches the support level, traders may expect a breakdown to occur, indicating a potential sell signal.

The pattern is usually considered a reliable bearish signal, but it’s important to note that there is no guarantee of a specific outcome and it’s always important to consider other technical and fundamental factors before making a trading decision.

Additionally, it’s also possible for the pattern to be a continuation pattern, meaning that the downward trend is expected to continue rather than reverse.

It’s crucial to wait for the pattern to be confirmed by a breakdown below the support line before acting on any potential trade signals.

Traders may also consider using stop-loss orders or other risk management strategies to limit potential losses.