CEX Vs DEX What is the Difference?

Today, We’re Going to talk about on Most Interesting topic which is Centralized Exchange Vs Decentralized Exchange what is the Difference between them… Read below.. I had Described all the necessary points Below

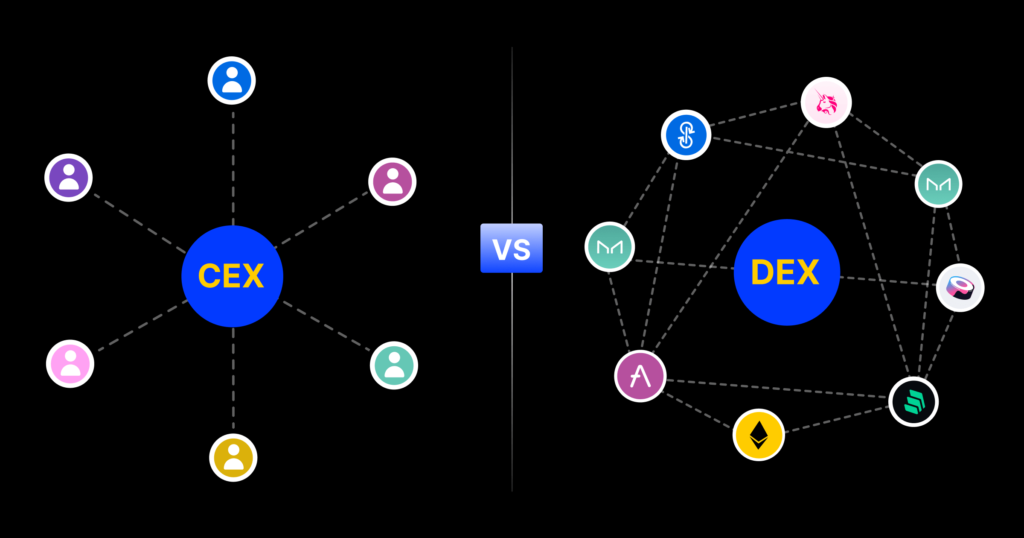

CEX vs DEX

CEX (Centralized Exchange) and DEX (Decentralized Exchange) are two different types of platforms that facilitate the trading of cryptocurrencies. Here’s an explanation of each:

Centralized Exchange (CEX):

A centralized exchange is a traditional exchange platform where users deposit their funds into the exchange’s centralized wallets. The exchange acts as an intermediary that matches buyers and sellers and facilitates the trading process. Key features of CEXs include:

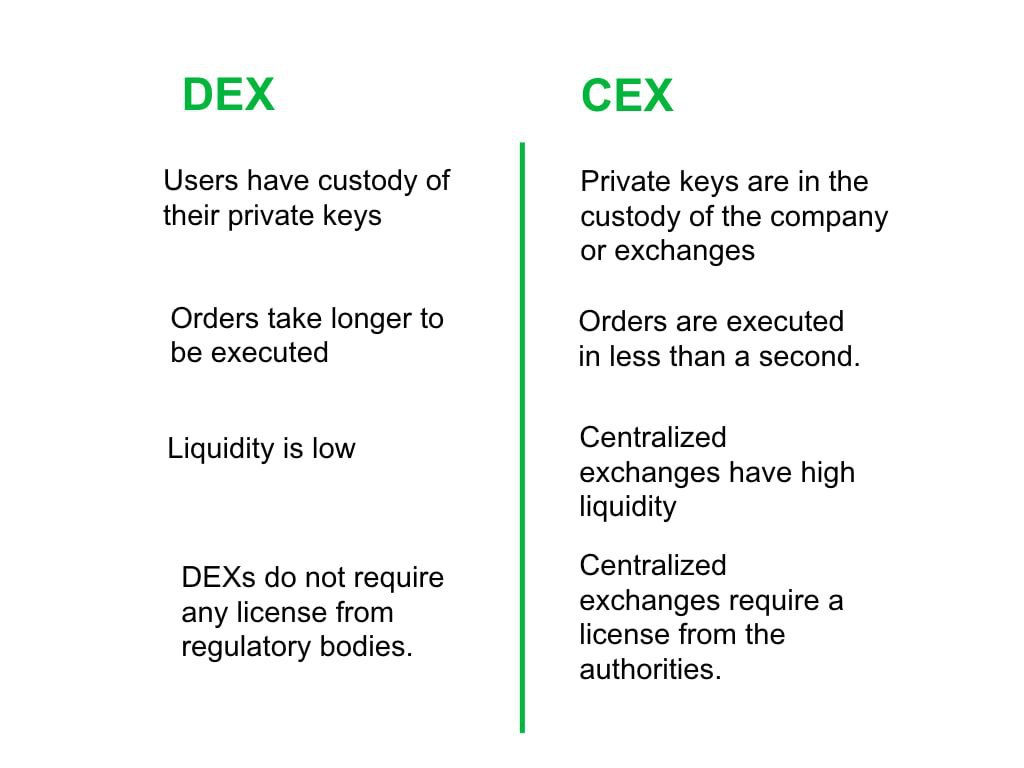

a) Control and Custody: CEXs have control over users’ funds as they require users to deposit their cryptocurrencies into the exchange’s wallets. Users rely on the exchange’s security measures and policies to safeguard their assets.

b) Centralized Authority: CEXs operate under a centralized authority or company that manages the platform, sets the rules, and controls the trading process. Users typically have to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, which involve providing personal information for verification.

c) Liquidity: Centralized exchanges generally offer higher liquidity due to their large user bases and active trading volumes. This makes it easier to execute trades quickly and at desired prices.

d) Order Books: CEXs typically use order books to match buy and sell orders. These order books consolidate the supply and demand for different cryptocurrencies, determining the market price and allowing traders to place limit orders at specific prices.

Examples of centralized exchanges include Coinbase, Binance, and Kraken.

Decentralized Exchange (DEX):

A decentralized exchange operates on a peer-to-peer network and eliminates the need for a central authority. It facilitates direct transactions between users, where individuals trade with each other without relying on a third party. Key features of DEXs include:

a) User Control: DEXs prioritize user control and eliminate the need to deposit funds into centralized wallets. Instead, users retain control of their private keys and directly connect their wallets to the DEX platform.

b) Decentralization and Transparency: DEXs leverage blockchain technology, using smart contracts to automate trade settlements. This enhances transparency, as all transactions are recorded on the blockchain and can be publicly audited.

c) Privacy and Anonymity: Some DEXs allow users to trade without extensive KYC requirements, offering more privacy and anonymity compared to CEXs.

d) Limited Liquidity: DEXs often face liquidity challenges since trading occurs directly between users. However, some DEXs use liquidity pools or automated market-making algorithms to enhance liquidity and provide better trading experiences.

Popular decentralized exchanges include Uniswap, SushiSwap, and PancakeSwap.

The choice between CEX and DEX depends on various factors such as user preferences, security concerns, regulatory compliance, liquidity requirements, and the desire for control over funds. CEXs offer convenience, higher liquidity, and regulatory compliance but require users to trust the exchange with their assets. DEXs prioritize user control, decentralization, and privacy, but liquidity can be more limited, and users bear responsibility for securing their funds.