What are Bullish and Bearish rectangle ?

Today, We’re Discussing about What are Bullish and Bearish rectangle in Trading ? firstly, there are two types of rectangle Bullish and Bearish.

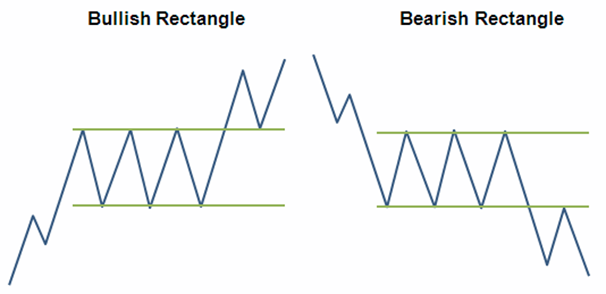

Bullish Rectangle Pattern

A bullish rectangle pattern is a technical chart pattern that occurs during an uptrend in the price of an asset. It is characterized by two parallel trendlines that act as support and resistance, creating a rectangular shape.

The bullish rectangle pattern typically forms when the price of an asset is in an uptrend and experiences a period of consolidation or trading range.

The upper and lower trendlines of the pattern represent levels of resistance and support respectively, with the asset’s price oscillating between these levels as it moves sideways.

The bullish rectangle pattern is considered a continuation pattern, indicating that the uptrend is likely to continue after the consolidation phase.

Traders and investors may use this pattern to identify potential buying opportunities, with a stop-loss order placed below the lower trendline to manage risk.

Bearish Rectangle Pattern

The bearish rectangle pattern is a technical analysis chart pattern that is often used by traders to identify a potential trend reversal. It is a continuation pattern that is formed during a downtrend and typically signals a continuation of the trend.

The pattern is characterized by a rectangle formation on the chart, with a support level at the bottom of the rectangle and a resistance level at the top.

The support and resistance levels are usually horizontal and parallel to each other.

Traders look for a break of the support level to confirm the pattern, which would signal a bearish continuation of the trend.

Once the support level is broken, traders may look to enter a short position with a stop loss above the resistance level.