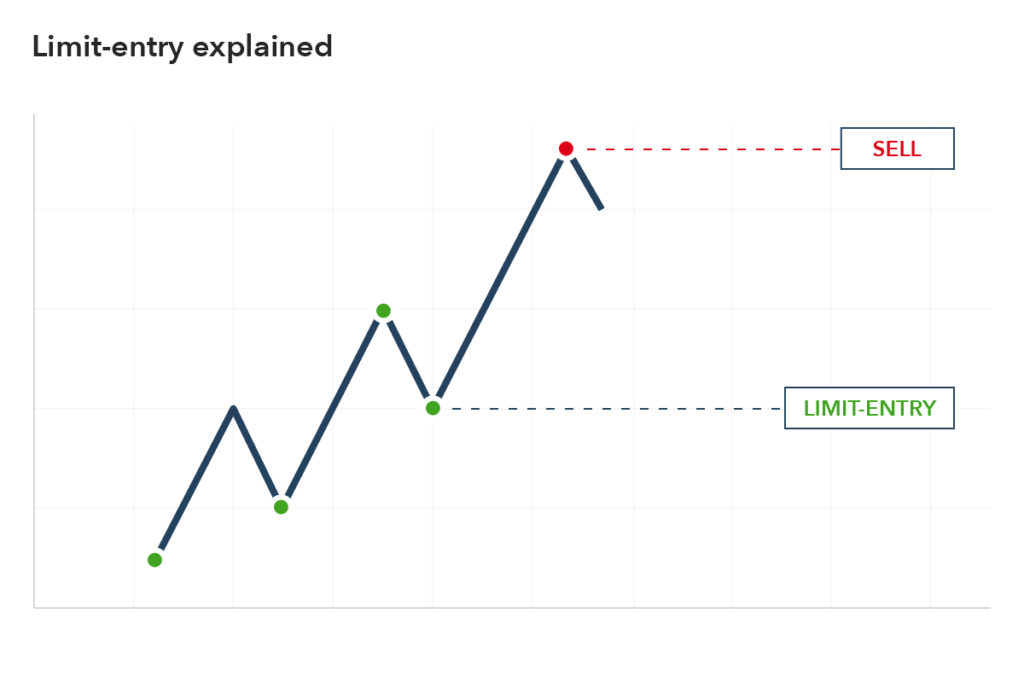

Today, we’re discussing What are Stop Limits? This is a very important concept for those who are trading futures. Mainly, There are 2 Types of stop limits:

•BUY Stop Limit

•SELL Stop Limit

When inputting a stop limit you enter the,

• “STOP” price

• “LIMIT” price

The stop price is the price that the order will be created if triggered.

If the price of the coin never hits the stop price, the sell order will never be created.

The limit price is the price the coin will sell.

Advantages of stop limits:

•You have better control over when the order is placed

•Secures Profits

•Manages Risk

•Safeguards you from corrections and makes you ready to re-buy at the lower prices

•It allows for less time spent monitoring daily and hourly price actions

Eg.

DGB / USDT

Current Price: $0.08

My TA tells me the price may start to fall rapidly if it breaks the next support level at $0.07.

I create a Stop Limit order:

STOP: @$0.07

LIMIT: @$0.065

If the price of DGB hits $0.070 the STOP price is triggered and the sell order is created to sell at $0.065.

If the price of DGB hits $0.065 it automatically sells.

If the price never hits $0.07 the order is never created.

If the price hits $0.068, then rises back up, the order is created but is never sold as it never hit the LIMIT price of $0.065.

With BUY Stop Limits it is the same concept but the STOP price creates a buy order and the LIMIT price executes the BUY order.