What is Cup and Handle pattern ?

Today, We’re Discussing about What is Cup and Handle pattern ? It is Usually seen when market is heading for reversal. it’s a Bullish pattern looks exactly like a Cup & it’s handle.

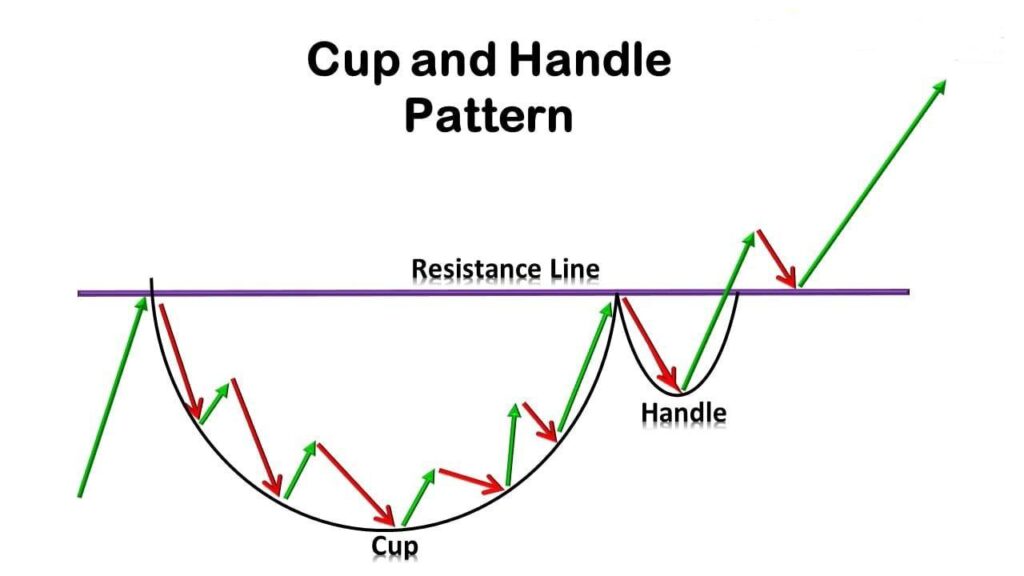

Cup and Handle Pattern

The cup and handle pattern is a technical analysis pattern that is commonly used to identify potential buying opportunities in the financial markets.

It is formed when there is a price trend in which an asset’s price drops, forms a U-shaped bottom, and then rises again to form a handle.

The “cup” portion of the pattern resembles a U-shape or a rounded bottom and shows a gradual price decline followed by a period of consolidation or sideways trading.

The consolidation period is usually followed by an upward trend, which forms the “handle” portion of the pattern. The handle portion is characterized by a slight downward drift in the asset’s price, usually with lower trading volume, before the asset’s price breaks out to the upside.

Traders and investors look for the cup and handle pattern as it indicates a potential bullish reversal in the asset’s price trend.

The pattern is considered reliable when there is high trading volume during the cup formation and a breakout occurs at the end of the handle formation, confirming the reversal.

However, it is important to note that the pattern is not infallible and may not always result in the expected price movement.

As with any technical analysis tool, it is important to consider other factors, such as fundamental analysis, when making trading decisions.